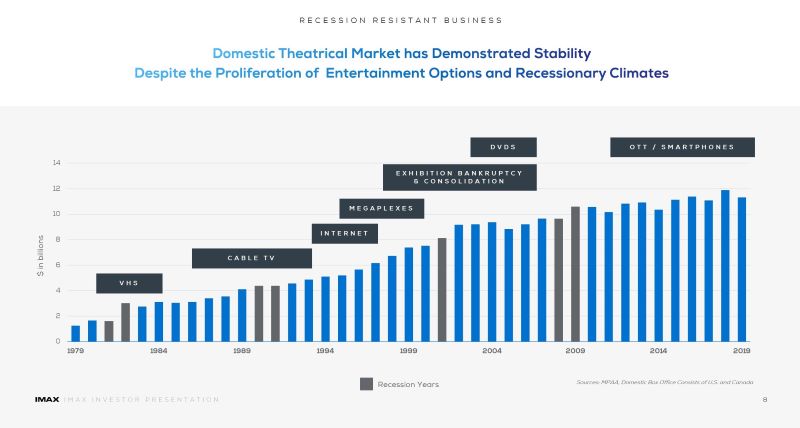

The big-format-screen Imax theaters are rebounding nicely from the pandemic and disruptions from Hollywood labor strikes, though the rest of cinema suffers from fewer movies.

That snapshot of the cinema business is optimistic. The Imax boom shows audiences are willing to pay a premium for tickets for a premium experience. Consumers want out-of-home entertainment, and not just cocoon at home video streaming.

The filmed-in-Imax drama “Oppenheimer” became a surprise global blockbuster lifted in part by Imax screenings; some tickets were reportedly resold for hundreds of dollars at opening in July, because consumers were jazzed by the Atom bomb-epic’s dazzling cinematography. The Universal Pictures-release “Oppenheimer” grossed $188 worldwide on Imax screens, roughly 20% of its global boxoffice total (Warner Bros. Pictures’ sci-fi epic “Dune: Part Two” also earned about the same one-fifth from Imax screens).

The premium-screen exposure lifted “Oppenheimer,” which won the Oscar for best picture and a producer thanked Imax in her Academy Awards acceptance speech.

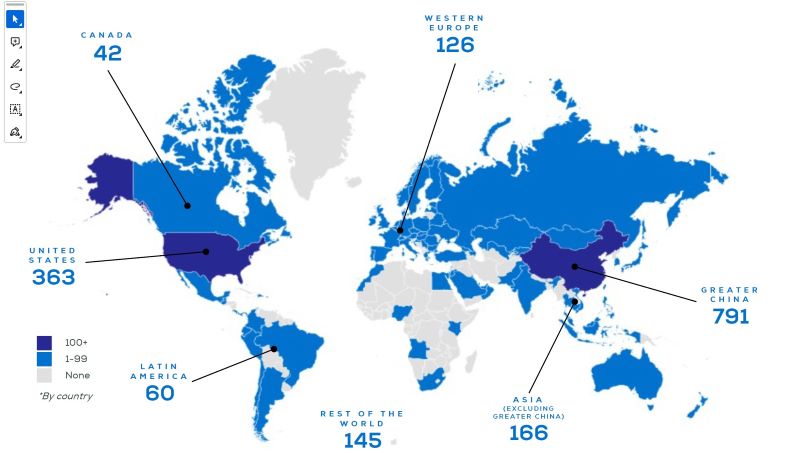

Imax tickets tend to be 50% to double the $10.53 national average (2022), though prices vary by region and because there are several grades of Imax screens. In pricey Los Angeles, an Imax ticket can run $28. In 2023, Imax theaters worldwide raked in $1.06 billion (second-best year ever for Imax), about 3% of global boxoffice; greater China is a big territory accounting for 25% of Imax’s worldwide boxoffice (see accompanying global theater map).

Some 32 theatrical films were released on domestic Imax screens in 2023, out of hundreds of total theatricals (the hundreds total includes many titles with limited cinema runs). There were 1,772 Imax projection systems operating in 90 countries at the end of last year.

Imax is king of the big screen, though Wall Street is cautious on the outlook for Imax, in part because the cinema business segment is so battered. Some theater chains offer larger-than-normal screen with slightly higher ticket prices. The generic category is called premium large format (PLF). “Mainstream theater circuits are gradually introducing giant-screen-lite initiatives, branding their largest auditoriums as big-screen wonders, which give home-theater users a reason to go out to the movies,” says the third edition of business/academic book “Marketing to Moviegoers.”

These include Cinemark XD, immersive ICE Theaters from France, THX Ultimate Cinema, Screen X panoramic and 4DPLEX from South Korea, to name some.

But over at conventional cinema, business is sluggish.

UK-based consultant and researcher Gower Street Analytics projected this week that global boxoffice will decline 3% this year to $$32.3 billion. That 2024 figure is slightly higher than an earlier estimate, but down 18% from the 2017-19 range, indicating no full recovery from the pandemic. Better growth would be expected coming out of the pandemic.

Of course, the Hollywood writers and actors strike in 2023 interrupted a return to full film flow. Normal flow of major studio blockbusters will have to wait until 2025, or possible a little later. And some comic-book adaptations have recently under performed, after being viewed as sure bets, which raises caution flags about upcoming releases. The disappoints include “The Flash,” “The Marvels” and “Ant-Man and the Wasp: Quantumania.”

There’s also a question what full film flow will be from the major studios because the parent of Paramount Pictures is negotiations to sell to new owners, though the would-be buyer is a fan of theatrical films. In 2019, Disney bought the 20th Century Fox film business, what is an industry consolidation.

Related content:

Leave a Reply