Hard times have hit the cinema business as the Bronx region with 1.4 million residents lost one of its two multiplexes; Walt Disney Studios’ once-dependable comic book adaptations are sputtering; and Paramount Pictures struggles to sell itself.

While recent developments are mostly unfavorable, Sony Pictures Entertainment agreed to buy movie-and-a-meal Alamo Drafthouse Cinema, which is the nation’s seventh largest cinema circuit. Having one of Hollywood’s five major movie studios buy into exhibition — the cinema business — is a vote of confidence.

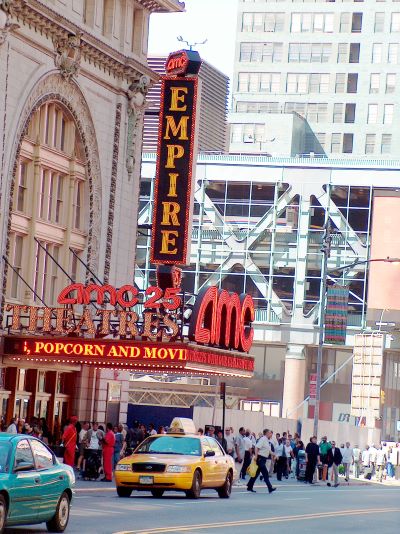

Cinema geographic coverage sports a gap in the Bronx, which is one of New York City’s five boroughs, after the National Amusements regional circuit announced closure of its Concourse Plaza Showcase cinemas last month. That theater sported about a dozen screens and opened in 1991. That leaves the Bronx with just one multiplex, which is the AMC Bay Plaza Cinema 13. While populous with 1.4 million residents, the Bronx is the lowest-income borough, with high property costs, meaning high theater operating costs. National Amusements said that it could not agree on lease renewal terms with its landlord, which reportedly wants to bring in another cinema operator.

Overall, boxoffice is in a funk, down 28% year-to-date from last year, a victim of pandemic hangover and two Hollywood labor strikes last year interrupting film flow. And year-to-date is off 43% from 2019, the last normal year before the Covid shutdowns.

Another tremor is that Walt Disney Studios, which accounts for more than a third of domestic (U.S./Canada) boxoffice in recent years, has stumbled. Disney releases “Elemental” and “The Marvels” fell short, with the studio losing its golden touch with animation and live-action comic book adaptations.

However, mid- and late-summer releases this year are auguring well in prerelease audience surveys, indicating a bounce. A more normalized flow of movies is expected sometime next year, and so theater operators hope to simply bridge over the current slump.

As of end of last year, a net decline of 2,000 U.S./Canada screens shrunk the cinema footprint in the pandemic aftermath, or about 5% contraction. It’s not clear if closures will continue or subside. At the start of the year, estimates put U.S./Canada at 42,000 screens.

Some modest erosion is certain, as this year’s reduced flow of theatrical films will prompt marginal theaters to close. The larger question is if the cinema industry is at risk of screen contraction to the point where boxoffice is crimped, even for blockbusters. That number would be around 30,000 screens, or about 32% off the pre-pandemic peak.

“Box office observers agree that the ecosystem is incredibly fragile,” wrote Pamela McClintock in the Hollywood Reporter, “but hang on to the hope that moviegoing will pick up in the coming weeks when all-audience tentpoles ‘Inside Out 2,’ ‘Despicable Me 4’ and ‘Deadpool & Wolverine’ come out, followed by ‘Beetlejuice Beetlejuice’ in early September. But there won’t be a steady volume of product until 2025.”

There’s also the constant nag of pundits saying video streaming will doom theaters, but that seems uninformed. Domestic theaters generated huge grosses for “Top Gun: Maverick,” “Barbie,” ‘Avatar 2” and others, which contradicts the gloomsters. Sports events, museums and music concerts continue to thrive with in-person audiences.

There’s no doubt that the Hollywood landscape is troubled because the auction of major-studio parent Paramount Communications fizzled, leaving that media/entertainment conglomerate in limbo. The parent of Paramount Pictures is weakened by its cash-cow cable TV networks declining amid cable TV cord-cutting and costs to build out its Paramount+ streaming service.

For the cinema industry, exhibition needs a full complement of major studios for film supply. 20th Century Fox Pictures was sold to Disney in 2019 and if Paramount were to downsize its output of theatrical films, that would be an economic blow to the flow of movies to cinema.

The Paramount Communications corporate auction indirectly involves Northeast U.S. circuit National Amusements, known for its Showcase theaters. The parent is Paramount’s controlling shareholder.

With cinema facing dry patches, it seems discounting ticket sales seems to be on the upswing today.

For instance, AMC rolled out its summer discount program earlier this month saying “providing movie lovers affordable options to experience the magic of movies this summer, with eight different ways to save money at the theatre.” Some tickets are $5, which is about half the national average. This and other cinema ticket discounts are annual affairs, but this year seem larger and more urgent this year.

The Milwaukee-based Marcus circuit in the Midwest is offering $7 tickets for kids and seniors for showings before 4 p.m. every day. “The program is one of many ways Marcus Theatres is making it more affordable for moviegoers to continue making memories at the theatre,” says a Marcus press release.

The Sony Pictures acquisition of Alamo Drafthouse is welcome because it brings a financially solid and movie-centric player into exhibition. The sellers are Altamont Capital Partners, Fortress Investment Group and circuit founder Tim League. The reported purchase price is around $200 million for its 35 theater locations in 25 metro areas and more than 10 million visitors annually.

Meanwhile, the two biggest domestic circuits, AMC and Regal, are in financing squeezes because of corporate debt piled on in years past.

It’s a little-known fact, but Sony Pictures has a positive history in exhibition, making the decision for its Alamo Drafthouse acquisition easier. When Japan’s Sony Corp. bought then-named major Hollywood studio Columbia Pictures in 1989, the studio foundered for years. But Columbia’s sibling Loews theater chain (sold in 2002) generated welcome and dependable cash flow though the turbulent 1990s.

Sony Pictures is the only of the five Hollywood majors without a mainstream video streaming service and, as foreign owned, isn’t allowed to have U.S. TV broadcasting licenses. Three other major studios have sibling terrestrial broadcast TV networks. So, Sony Pictures plants its flag in U.S. media with the Alamo Drafthouse acquisition.

Alamo Drafthouse will go into Sony’s new live events business segment called Sony Pictures Experiences, which will be led by Alamo Drafthouse CEO Michael Kustermann. He will keep his position as head of the theater chain.

In taking over Alamo Drafthouse, Sony Pictures will get a movie theater with an attitude. The chain is famous in cinema circles for an audio advertisement from 2013 that plays a real-life phoned-in complaint from an indignant moviegoer who had been bounced for violating rules against txting with cell phones in the theater.

Related content:

Leave a Reply