Across Hollywood, studio executives are suddenly singing the praises of full exclusive cinema runs for movies, and dialing back their infatuation with video streaming.

A Variety story by Brent Lang and Rebecca Rubin calls it a case of “Netflix envy” fading. “Lately, Wall Street has soured on the economics of streaming, believing that the media conglomerates that run these services [such as Disney+ and HBO Max] need to be as focused on making money as they are on attracting subscribers.”

It’s recognition that cinema exhibition generates good revenue streams, movies with cinema runs are more valued by consumers over time, and hording all content for corporate sibling streamers is bad economics. Building and maintaining in-house streaming platforms generates billions in red ink.

Warner Bros. Discovery president/CEO David Zaslav, a corporate chieftain who is a newcomer to Hollywood’s inner circle, was the provocateur who first articulated and pursued the strategy. Rather than horde for his HBO Max, he advocated licensing some Warner Bros. studio content to third parties. No doubt that heavy debt at Warner Bros. Discovery made the cash-in-now approach more appealing.

The research arm of Hollywood talent agency UTA (United Talent Agency) shows moviegoers are onboard too. Research and analytics UTA IQ finds the biggest impediment to achieving pre-Covid boxoffice levels is Hollywood has yet to return to normal release output, since the pandemic interrupted film production and output. Domestic boxoffice (U.S. and Canada) year-to-date is running 24% behind 2019, though well ahead of pandemic battered 2020-22.

In the survey, UTA IQ found that two-thirds of respondents said the gap between a movie’s theatrical release and later streaming window for the same film has little impact on the desire to see in theaters. That gap ranges from 15 to 90 days for a subscription streamer; 45 days is now typical. Some movies have shorter windows for premium-video-on-demand where there’s a hefty charge for the one movie before its later subscription-VOD run. There are ongoing field trials with different windowing.

Some 33% of respondents said they’d immediately increase cinema going if there were more appealing titles; again cinema output is still recovering from the pandemic. “The study proves what we intuitively believed that there is nothing wrong with the movie business that better films and cleaner theaters can’t fix”, said Jeremy Zimmer, CEO of UTA.

On the lasting cinema halo effect, the UTA IQ survey found theatrical films are far more potent in terms of consumer awareness than films made for streaming premiere. “Unless the streaming original was a sequel or based on existing IP, awareness for each is below every theatrically released film asked about. Even Netflix’s most expensive original film, ‘The Gray Man,’ has less awareness (51%) than the least recalled theatrical movie on the lists, ‘Everything Everywhere All at Once’ (56%). … When asked to name the most recent original streaming movie they watched, only a quarter of consumers correctly listed one.”

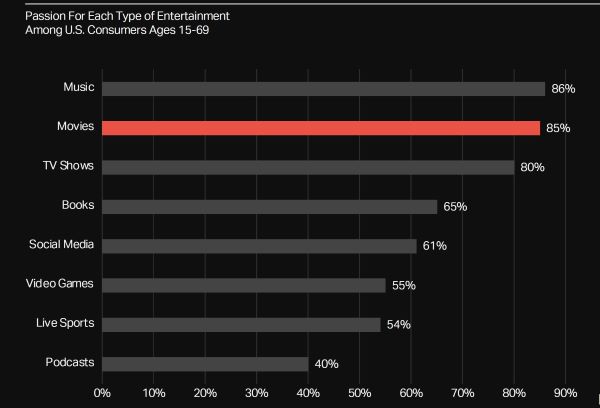

The film genre remains very popular. Of eight media options, movies are practically tied for No. 1 in a UTA IQ consumer finding on “passion for entertainment” (see accompanying table).

UTA IQ surveyed 2,000 U.S. consumers ages 15-69 in January. Hollywood’s third-largest talent agency, UTA self-describes itself a talent, entertainment, sports and marketing company.

Naysayers suggest only blockbusters thrive these days, like Paramount Pictures’ “Top Gun: Maverick” and “Avatar: The Way of Water.” Gee, those are the backbone for viable economics having grossed $1.5 billion and $1.6 billion respectively worldwide. Those are huge ticket sales, which landed those movies among top grossers of all time. They sold a lot of over-priced popcorn too!

It is true that mid-level budget films and movies for niche specialty audience struggle because their lower boxoffice prospects make it more difficult to justify big advertising support. Also, streamers acquire those mid-budget films aimed at sophisticated audiences, removing them from theatrical runs.

There are problems facing the cinema revival. Cineworld, the United Kingdom-based multinational, is working through bankruptcy from heavy debt and pandemic pain; it owns the giant Regal circuit in the U.S.

Also, older demographics have been slow to return to cinema; the thinking is that’s driven by health concerns where a medically vulnerable population avoids crowds.

Finally, Netflix, with its giant content spending, does not embrace major movie theater runs for its originals. When its produced films do have a movie theater play, it’s usually truncated and seems to be done only to placate creative talent.

There has been a lot of chatter about cinema dying, which has been annoying because the arguments put forward are obviously flawed. It seems the less the proponent person knows, the more forceful that they make a case that doesn’t hold up under scrutiny.

If one argues consumers won’t go out to movies because of ticket prices, sticky floors, being charged for parking, other patrons being noisy, crowd health concerns and baby-sitter expenses, then concerts and live attendance to sports events are going to die too. But nobody argues that!

Related content:

Leave a Reply