Indie blockbuster “Sound of Freedom” raised $5 million from 7,134 small investors for its marketing expenses, which is an out-of-Hollywood story involving grassroots America. The $5 million covered “prints & advertising” (P&A) theatrical releasing expenses.

This crowd-funding effort is the realization of much talked about, but seldom achieved, leveraging of a motivated core audience (or demographic). That core audience provides early-stage finance and initial enthusiasm in the consumer market. In this case, the affinity demos are people who are deeply religious and traditional-values conservatives.

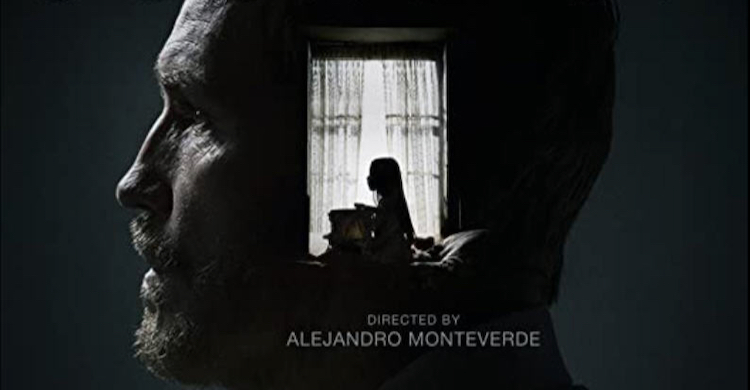

“Sound of Freedom” is an PG-13-rated drama about child slavery distributed by Provo, Utah-based Angel Studios. The movie has grossed an astounding $134 million in just 22 days in domestic (U.S./Canada) cinemas. Angel Studios founders are four brothers, Neal, Daniel, Jeffrey, and Jordan Harmon, who created the company in 2013 focused on all-family and uplifting audio/visual content.

Angel created a cottage industry of crowdfunding built around a theme of “Investing in Stories That Amplify Light.” Among Angel projects listed for funding is the animated biblical movie “David” with nearly $5 million raised (this offering is labeled as “closed”) and “Testament,” which is a live-action retelling of the Book of Acts set in the contemporary world with just $448,850 raised. About a score of prior and pending projects are listed.

Angel Funding solicits investors under loose federal Regulations For Crowdfunding, better known as Regulation CF, applicable to offerings of $5 million or less. Reg CF is far less stringent than rules applied to big corporate fundraising. One key easement is Reg CF investors don’t have to be formally designated as Accredited Investors, or high rollers, and also entities with a prior relationship to the fundraiser. Those restrictions apply to most regulated public offering, though not Reg CF.

Angel Funding did not respond to queries, particularly on how it assembles investors and the design of its movie marketing campaigns. However, finding investors is probably done by tapping into the faith ecosystem of religious organizations, high-minded non-profits and churchgoers.

“The security being sold is a revenue participation agreement,” says an Angel Studios Form 1-SA in 2021. “If the theatrical revenues are enough to cover the cost, there will be up to 120% return of investment. If the theatrical release does not earn enough, investors would lose some or all of their investment. … No, this is not an opportunity to purchase equity in ‘Sound of Freedom.’”

So, the top return for investors is 20 cents on every dollar. Investors don’t own any stake in the “Sound of Freedom” itself, but just the marketing campaign that includes trailers; commercials; print and social media advertising; and publicity.

One benefit of corralling a crowd for funding is those persons will buy cinema tickets, including via a give-away program called Pay It Forward. Explains Brian Welk writing in IndieWire: Pay It Forward involves buying tickets that are donated to others that “don’t have the financial means. A larger group of people buying tickets in bulk, such as for a company or a church, can even redeem a portion of their tickets for free. The distributor says of its $14.2 million [premiere weekend] haul, $2.6 million came from people overpaying through those Pay It Forward ticket sales. That’s not just a few ‘angel’ investors, either. Angel Studios’ website boasts that over 200,000 individual contributors chipped in for additional tickets, with a goal of 2 million tickets sold in the first week.”

Angel has its crowd funding down to a science, as its website says. “Angel Studios is a streaming media service that offers family friendly entertainment that amplifies light, with titles including ‘The Chosen,’ ‘Dry Bar Comedy,’ ‘His Only Son,’ ‘The Wingfeather Saga,’ and ‘Tuttle Twins.’ We focus on content supported by equity crowd funding, where individual investors have the opportunity to share ownership in the titles.”

Angel successfully crowd-funded $1.235 million in just a few days for P&A for theatrical release “His Only Son,” which grossed $12 million in domestic boxoffice. That’s not up to “Sound of Freedom” standards for domestic boxoffice but is still pretty good for an indie film. “His Only Son” premiered in cinemas March 31, 2023 (Easter weekend).

Across the movie industry, P&A is desired to create a theatrical halo, which a film wears in all its later release windows, says “Marketing to Moviegoers: Third Edition”, the business/academic book: “Theatrical release alone can be a loser financially … the film can recover with downstream DVD, online, and TV sales. P&A spending in theatrical release helps establish values in subsequent windows, thus building consumer awareness even if boxoffice is mediocre.”

P&A funding is attractive to investors because it is usually the last money in put in a film project but P&A investors are the first to get paid off. “P&A investors will receive funds after the theaters take their cut and before any other investors and/or owners,” says an Angel filing.

Related content:

Leave a Reply