Experiencing sudden chaos from an unexpected leveling of growth, Netflix, Disney+ and other subscription video-on-demand (S-VOD) services are shoring up their economics, trying to curb costly customer churn.

Hot competition among S-VOD platforms made for lax industry practices such as generous account sharing; signups with no contracts allowing for quick cancellations; and free or discounted marketing trials. The image atop this post is for NBC Universal’s Peacock streamer touting, “Plans start at Free — no credit card required.”

The lax subscriber acquisition practices are a consequence of a “land grab” mentality among streamers that Wall Street mostly judged on subscriber growth, regardless of cost; with growth suddenly leveling that is a sign of industry maturity, the investors’ yardstick will increasingly shift to profitability.

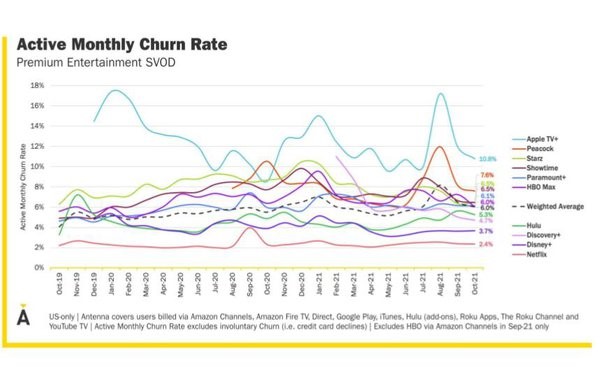

Churn is a metric measuring voluntary subscriber cancellations often expressed as a percentage of total subs. It’s typically calculated on a monthly basis. Churn has a seasonal quality, is affected by programming, price cuts, price increases and definitions vary such as typically not counting involuntary cancellations when dropping subscribers who don’t pay their bills.

Various industry sources suggest Apple TV Plus currently has the highest monthly churn rate, estimated at around 10.4%, research company Antenna said in March. In simple arithmetic, that churn rate translates into the equivalent of the whole Apple TV Plus subscriber base turning over every 10 months.

Meanwhile, Netflix ended 2021 with an industry-low monthly churn rate of just 2.2%, down from 2.5% at the start of the year. Disney+ is next at a 5% churn rate, benefiting by potentially being bundled with corporate siblings Hulu and ESPN Plus. For the S-VOD industry on average, churn tends to average in the high single digits — or roughly 6-8%.

Offsetting churn are new customer additions — but in some cases those newbies are short-timers enticed by no contract commitments and upfront discounts. In comparison, the cable TV industry historically experienced around a 2% churn rate; cable operators benefit from geographic monopolies. Mature music subscription services incur roughly double the cable churn rate, in part because music streaming consumers can subscribe to all services (which is also a characteristic of S-VOD).

So the S-VOD industry, shifting to an emphasis on profitability, is clamping down on discounting, free trials and account sharing. This will create more harm than good. And more emphasis on subscriber retention to reduce churn.

The video streaming industry received a jolt April 19 when leader Netflix reported a net gain of just 500,000 subscribers worldwide (excluding the turnoff in Russia because of the Ukraine invasion). That came in Netflix quarterly earnings for the January-March period, when Wall Street analysts were expecting a net gain of 2.6 subscribers. That’s a big miss of expectations. In what was perhaps an advance signal of disappointment to come, Netflix replaced its chief marketing officer in March after just two years at the company.

As a result of the April 19 earnings shortfall, investment analysts punished the whole S-VOD sector after concluding ultimate build-out — meaning the upper ceiling for the entire industry — is lower than previously expected. A fallout is that streamers are dialing back on ambitious program spending.

Netflix reported a still-healthy 222 million subscribers worldwide in the January-March quarter. Disney+ weighed in with 137.7 million subs for the same period, and Disney stuck with its forecast subscriber count climb to 230 million accounts by end of its fiscal 2024.

But little discussed is that those fat global counts increasingly encompass low revenue subscribers in offshore territories, far below the $9 a month average for S-VOD in the U.S. For example, in India, the Netflix subscription price translates to $3/month.

“Amid tumbling subscriber numbers, Netflix finds itself in an entirely different landscape to its pandemic heyday,” GlobalData thematic analyst Francesca Gregory said in an April commentary. “Netflix is considering shifting to ad-based models and cracking down on account sharing. Although this would improve revenues, these shifts will potentially compromise user experience, which has been a central tenet to Netflix’s past success.”

As for actions to reduce churn and grab new subscribers, streamers are spreading out availability of programs to deter subscribers from watching an entire series or arc of movies at once and then canceling their subscriptions. That puts a brake on everything-at-once binge-watching, which Netflix pioneered. S-VOD platforms are also expected to dial back on cutthroat discounting, since Wall Street’s mantra is shifting to profitability that requires a stable subscriber base.

The major movie studios are buttressing their in-house platforms with theatrical movies after playing short cinema-exclusive runs. “Starting this year, Peacock will stream select Universal films as soon as 45 days after their theatrical release,” says a Business Insider article by Kevin Webb. “That said, big titles like ‘Jurassic World: Dominion’ will likely take longer to hit Peacock” with longer than 45-day cinema exclusive windows, if still doing good boxoffice.

The traditional S-VOD platforms with no advertising and relying solely on payments by subs are coming under pressure from “free” advertising supported VOD platforms, such as Crackle, Freevee (formerly IMDb TV), Hoopla, Kanopy, Peacock, Pluto TV, the Roku Channel, Tubi TV, Vudu and Xumo. Even holdout Netflix is warming to an A-VOD (A for “advertising”) service; “It’s not like we have religion against advertising,” joked Netflix CFO Spencer Neumann at the Morgan Stanley conference in March.

Netflix is tightening account sharing by charging small extra fees for multiple people on the same account, and thus not letting many people freeload on one account. “We’re still working through the ultimate solution here” for extra fees for accounting sharing, Neumann said in the April earnings call. “So we don’t exactly know how that’s going to play out.” Netflix estimates 30 million subscriber accounts in the U.S. and Canada have sharing freeloaders who don’t pay extra.

In another sign of streaming shakeup, platforms increasingly add live sports (which sector leader Netflix rejected for years) on the expectation sports is a magnet for retaining subscribers. Sports fans can’t binge watch with the intention of a quick cancel.

The S-VOD sector grapples with so-called “darters” — customers whose intent is to be short-term subscribers to binge-watching desired content and exhausting signup discounts/free trials. Expect the industry to increasingly brush off darters, instead of tolerating them as in the past.

Related content:

Leave a Reply