Netflix is pouring billions into original TV programming and competition is intensifying, so the leading video streamer is listening more closely to its subscribers.

For about a year, Netflix impaneled 2,000 subscribers (out of its 223 million worldwide currently) to give feedback on its original programs in what it calls its Preview Club; this effort will grow to 10,000 globally next year, according to a Wall Street Journal newspaper story. Feedback helps in marketing its originals, which are “new products.”

Netflix has business information on its subscribing households, but it’s not clear how much individualized viewing data is received for households with multiple users. The basics are address and viewing preferences for the account since Netflix serves up each video. But to single out individuals, they have to have set up and use a “personal profile.”

According to the WSJ article, Preview Club feedback prompted Netflix to punch up comedy in marketing “Don’t Look Up,” its $75 million movie starring Leonardo DiCaprio and Jennifer Lawrence. The political satire movie about the scramble when Earth faces an impending comet collision initially projected a more serious marketing message.

“Netflix isn’t the only streamer in the business that uses test audiences,” says the WSJ article by Sarah Krouse and Jessica Toonkel. “Amazon Prime has the ‘Amazon Preview’ program, which similarly gives feedback on TV pilots and films, while Hulu has a ‘Hulu Brain Trust’ program, which allows subscribers to give feedback and answer research questions related to content after it launches.”

If this sounds innovative, it isn’t. The Nielsen TV/cable ratings have tracking viewership for decades, now with a panel of 42,000 selected and connected households; in the earliest days of TV, Nielsen estimated audience size from samples in the single-digit thousands that industry felt were valid. Nielsen connects viewing devices that identifies viewing by each person. The 42,000 impaneled households encompass 100,000 persons, plus Nielsen has deals for TV settop box viewing data.

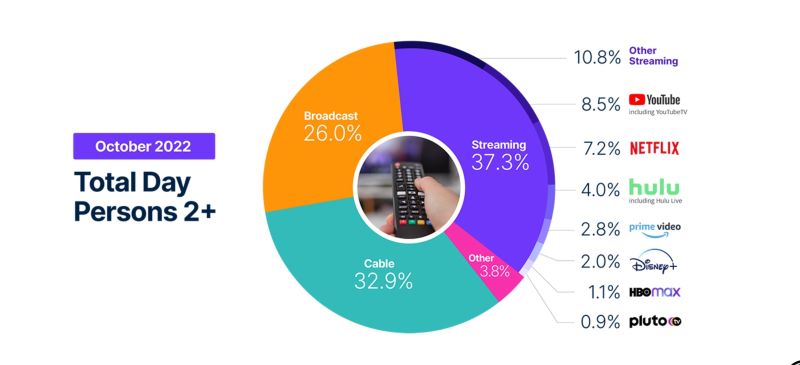

As for Netflix, prior to its interest in selling advertising, the streamer had no reason to publicly disclose audience viewership. Producers and creative talent would get a dashboard of basic viewing data for their content only. That information was limited and provided no context comparing to other shows. In May, word began to leak out that Netflix said that it would launch a cheaper service option with advertising sometime in 2023. Going the advertising sales route requires disclosing audience to third parties, so Netflix could no longer keep viewership in the dark.

Netflix cranks out new programming spending $17 billion a year on content, which is an astronomical amount consider virtually none is in pricey sports. The current spend is about double the streamer’s content budget in 2016. The subscription video-on-demand business got crowded with Disney+, Paramount+ (formerly CBS All Access), HBO Max and others piled into the sector in just the past few years.

Given Netflix serves up each subscriber connection, it knows what time of day viewing occurs and on what devices; when pauses and fast-forwards occur; if shows are watched to the end; at what point viewers exit (and looking if viewers sign off en masse at the same points); the viewing history of each subscriber; and demographic profile. It’s not clear, however, if Netflix segments viewing from multiple persons in the same household.

Netflix declined to comment on this story and is usually tight-lipped. However, its website has some great chestnuts on its audience research efforts, some of which are very wonky. It’s not surprising because Netflix is famous for being data driven.

One post says Netflix employs machine learning — using software to predict outcomes — and statistical modeling as tools for program decisions. Audience response to similar content characteristics is parsed in this exercise.

“For each source task, we learn a model on a large set of historical titles, leveraging information such as title metadata (e.g., genre, runtime, series or film) as well as tags or text summaries curated by domain experts describing thematic/plot elements,” says a Netflix post titled “Supporting Content Decision Makers With Machine Learning” in December 2020. “Once we learn this model, we extract model parameters constituting a numerical representation or embedding of the title. These embeddings are then used as inputs to downstream models specialized on the target tasks for a smaller set of titles directly relevant for content decisions. All models were developed and deployed using metaflow, Netflix’s open source framework for bringing models into production.”

Netflix Research Timeline

2022

- December: Plans increase to 10,000 subscribers of its Preview Club internal research panel used to evaluate its originals, from 2,000 subs

- October: Signs for independent audience measurement in United Kingdom with ratings service BARB, as does Disney+

- June: Streamers coral one-third of TV audience; Netflix alone accounts for 7.7% of total TV viewing, per Nielsen

2021

- December: Releases total viewing minutes of its top shows, supplanting prior the two-minutes-is-a-view metric

- April: Nielsen measures streaming video viewing in 9,000 household to augment its TV/cable audience data

2020

- Counts as a “view” if a subscriber watches 2 minutes of a title within its first 28 days of availability.

2017

- Replaces its five-star format for audiences rating content with a two-prong thumb up/thumb down

2013

- Streams first original “House of Cards” that becomes a hit

2006

- Announces “Netflix Prize” for the best mathematical algorithm to “substantially improve the accuracy of predictions about how much someone is going to enjoy a movie based on their movie preferences”.

2005

- Independent researchers release the first public estimates of Netflix viewership based on interviews with subscribers

Related content:

Leave a Reply