Marketing of subscription video-on-demand for Netflix and HBO Max was rocked in the past week. The high-flying stock price of Netflix cracked, and also subscription prices were raised and lowered, in an apparent contradiction.

Netflix raised its subscription price Jan. 14, and then days later competitor HBO Max instituted a limited-time price cut. Netflix increased its standard plan from $15.50 per month from $14, while its 4K plan jumps to $20 per month from $18. Its basic plan, which doesn’t include HD, is also rising to $10 per month from $9. Prices are also going up in Canada as well.

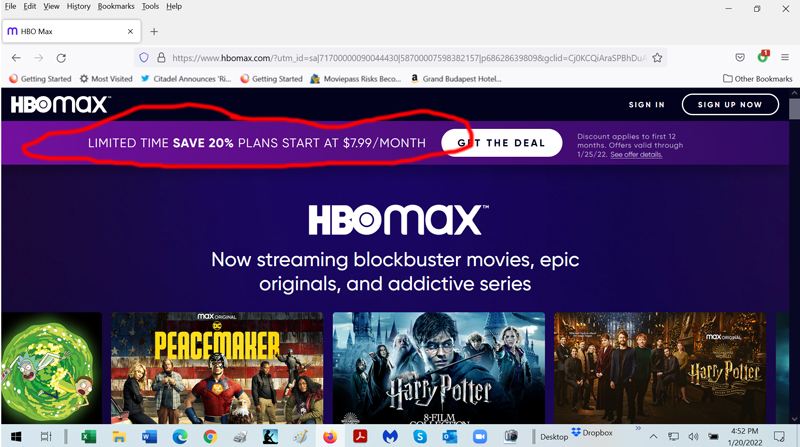

Meanwhile, HBO Max, which is the high-flier of top-tier subscription-VOD platforms at the moment, is offering monthly subscriptions at $7.99/month for a year for its advertising-free version, down from $9.99, apparently hoping to scoop up some Netflix subs defecting. The HBO Max offer, which translates into a 20% discount from the regular price, expires Jan. 25 (see HBO Max homepage graphic and “limited time save 20%” circled at upper left).

This turmoil erupts as growth in the red-hot S-VOD sector, which Netflix pioneered, is deaccelerating faster and sooner than expected. The sector is still growing, but may have a lower ceiling that stock analysts had forecast.

The deacceleration first surfaced when Disney+, which got off to a fast launch in in November 2019, surprised investors back on Nov. 10 revealing that Disney+ growth was short of expectations. Now Netflix is also showing the blahs, which it blames on intensified competition. Since competition is itself a growing state-of-affairs, the recent rock-’em-sock-’em is not expected to eventually fade.

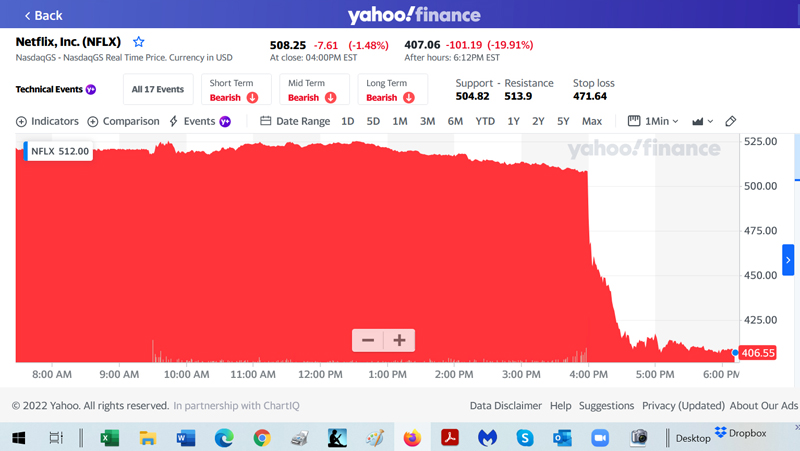

On its quarterly earnings call late yesterday, Netflix mixed bad news with good news, in what looks like a pivotal quarter for the streaming giant that usually hits or exceeds Wall Street’s targets. That sparked a severe sell-off in the thin after-hours trading for its shares, which plunged from roughly $500 to $400 (see graphic). That sliced the Netflix stock market capitalization (valuation of all its shares) by $50 billion to settle at about $180 billion in after-hours trading, from around $230 billion before. The stock then closed down almost 22% in regular trading.

For the quarter, Netflix announced a worldwide total of 221.84 million subscribers, which was 200,000 subs below expectations. But more worrisome is that future guidance for users headcount is lowered and that really spooked investors. The good news is that quarterly revenue of $7.7 billion met expectations and earnings exceeded, but that good news is in the rear-view mirror. It’s future trends that concern investors. (In comparison, HBO Max ended 2021 with about 73.8 million subscribers, which is pretty good for the service that only launched in May 2020).

“Our view is that the pandemic pulled forward massive amounts of demand for numerous players including Netflix and across the board it is taking longer than expected for gross subscribers to normalize,” wrote Jeff Wlodarczak, a senior analyst at Pivotal Research. He remains bullish on Netflix for the long term.

Investors were perplexed Netflix raised subscription rates just a week before announcing its mixed earnings and lowering some forecasts. Investors were also surprised that Netflix doesn’t seem inclined to dial back on its huge spending on programing — $17 billion in 2021, which is a staggering figure because the theatrical film slates of all Hollywood’s major studios only approach $10 billion. In 2016, Netflix spent just an estimated $5 billion on content. The author can remember being on Netflix earnings conference calls years ago when stock analysts complained to company brass of too much spending on content. However, that ballooning content spend propelled Netflix.

Huge content spending saddles Netflix with a junk-bond level corporate credit rating. Unexpected growth deacceleration and heavy debt puts Netflix in a tight spot; a usual corporate response to that toxic debt cocktail is trimming spending to conserve capital, but not at Netflix so far.

Netflix blaming soft guidance on growing competition is a first, but a surprise. Major S-VOD rivals multiplied with arrival of Peacock from Comcast’s NBCUniversal, Apple+ and Amazon Prime, in addition to the previously mentioned Disney+ and WarnerMedia’s HBO Max. Competition became particularly intensive in the past two years. “Even in a world of uncertainty and increasing competition, we’re optimistic about our long-term growth prospects as streaming supplants linear entertainment around the world,” Netflix told shareholders.

Netflix is walking a tightrope. The streaming leader has consistently been raising monthly prices in increments over the past few years, justifying to subscribers that it’s to pay for growing originals. Though Netflix doesn’t discuss this much, a problem for Netflix is that it can no longer acquire top films and TV series from Hollywood, which was a good value proposition for Netflix to “pay for success” in its earlier days. But the major studios now horde their content for their own platforms. So, Netflix subscribers no longer get popular theatrical movies and binge-watch popular TV series from linear TV.

Related content:

Leave a Reply