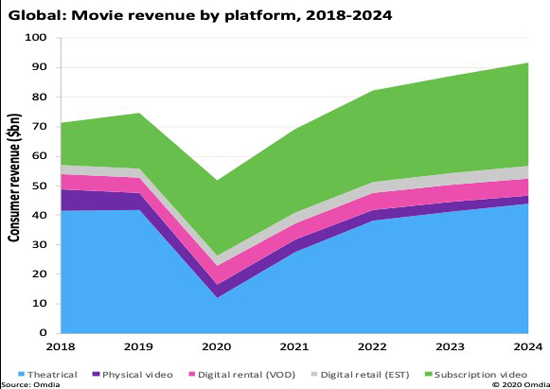

Global boxoffice revenue will decline $32 billion due to Covid-19 closures, representing a 71.5% plunge, estimates a London-based researcher that is nonetheless upbeat about a healthy though not complete rebound in two years.

Omdia Research’s latest syndicated report “Movie Windows: Adapting for the Future” forecasts 2020 global boxoffice will amount to just $13 billion, for that 71.5% decline. By 2022, Omdia sees global boxoffice bouncing back to around $40 billion that is just under 2019 and prepandemic levels (this excludes other revenue such as food/beverage). Researchers are bullish on cinema’s outlook post-pandemic because major studio movies are piled up waiting for release and consumers want to resume out-of-home life once there’s an “all clear.”

How do cinemas stay afloat waiting for a return to normal post-pandemic? Texas-based circuit Cinemark, with 533 theatres and 5,974 screens in the U.S. and Latin America, says that it rented it theater auditoriums for over 100,000 private cinema presentations during shelter-in-place. Those private screenings accommodated 1.3 million admissions since announced Oct 1. Cinemark is the third largest cinema operator in the U.S.

Private screenings involved known friends and family, so audiences more comfortable than with general admission. “A Cinemark Private Watch Party allows guests to rent an entire auditorium for up to 20 people for just $99 for library content or $149 for new releases, plus tax where applicable, with no minimum concession purchase,” says a Cinemark press release.

Cinemark’s overall action plan to deal with the financial Armageddon from Covis-19 was outlined in an August quarterly earnings presentation to its shareholders:

* Eliminate capital expenses and cut other costs to the bone.

* Restructure operations to save money.

* Streamline food/beverage products—which are high-profit-margin for cinemas—to core items; such concessions are labor intensive.

* Negotiate delayed payments, such as real estate leases.

* The circuit suspended its cash dividend to shareholders.

* Get waivers on performance covenants from lenders on financing agreements, since Covid-19 sunk financials to previous unthinkable lows.

* Raise more capital. For example, in August, Cinemark arranged $400 million in face value senior convertible notes through a private placement (scheduled for repayment in 2025 that should bridge the virus era) and another $250 million in notes in April.

* Apply for government grants and financial relief.

“We believe pent-up demand for out-of-home entertainment, along with a backlog of strong films content, bodes well for exhibition,” the presentation observes.

Making the case for a turnaround, Omdia senior director-media and entertainment Maria Rua Aguete said in a statement: “COVID-19 also created a bottleneck of new releases which puts into question the traditional windowing model as downstream revenue sources suffer from the lack of new releases onto other platforms in 2020 and 2021. It has also created a unique opportunity for studios to experiment with other distribution models such as PVOD or and to a lesser degree straight-to-streaming without equivalent relationship damages as before.”

In a radical example of “studios experimenting,” Warner Bros. rattled cinemas with its Dec. 3 announcement its whole slate for 2021 will premiere on its sibling HBO Max streaming service at the same times are cinemas. The window-compressing initiatives now happening are difficult to gage because studios sometimes give a cut of streaming revenue to theaters, is the case with Universal Pictures pact with AMC Theatres and other exhibitors. So, some initiatives do bolster exhibition with revenue sharing, mostly of premium-VOD (P-VOD).

And other industry stakeholders object to window compression. The Warner Bros. announcement of simultaneous play on HBO Max drew a rebuke from labor union the Directors Guild of America and others. In a leaked letter from the powerful talent agency CAA to Warners, CAA complained the compressing streaming with theatrical “dramatically harms our clients’ ability to earn backend compensation [financial bonuses], which they negotiated for, expected, and have every right to protect.” The traditional sequential distribution triggers bonus when movies hit windows that would seem to be swept away.

So the cinema business is roiled by on-the-fly adjustments in movie distribution and awaits better days when the Covid-19 subsides; consumer eventually will out-of-home activities.

Related content:

- Variety: Cinemas Suffer Massive Covid-19 Loss of BO Rentals

- Cinemark PR: Cinemark Celebrates 100,000 Private Watch Party Milestone Driven by High Consumer Demand

- Washington Post: Did Warner Bros. Just Kill Movie Theaters? Not by a Long Shot

Leave a Reply